How many of folks count our duty? The truth is, hardly if any. Each morning eyes of the government, not all income sources are treated equally. For example, when you are working for your employer as an employee and you duly pay your taxes at the end of the 12 month period. This has been going on for several years. The amount of taxes paid is noticeable to because the same each year (give and take). Therefore, it will appear as though that earned income staying taxed equally each occasion.

10% (8.55% for healthcare and 1.45% Medicare to General Revenue) for my employer and me is $15,612.80 ($7,806.40 each), which is less than both currently pay now ($1,131.93 $7,887.10 = $9,019.03 my share and $1,131.93 $8,994 = $10,125.93 my employer’s share). For my wife’s employer and her is $6,204.41 ($785.71 my wife’s share and $785.71 $4,632.99 = $5,418.70 her employer’s share). Lowering the amount down to a 3 or more.5% (2.05% healthcare 1.45% Medicare) contribution every for earnings of 7% for lower income workers should make it affordable for workers and employers.

10% (8.55% for healthcare and 1.45% Medicare to General Revenue) for my employer and me is $15,612.80 ($7,806.40 each), which is less than both currently pay now ($1,131.93 $7,887.10 = $9,019.03 my share and $1,131.93 $8,994 = $10,125.93 my employer’s share). For my wife’s employer and her is $6,204.41 ($785.71 my wife’s share and $785.71 $4,632.99 = $5,418.70 her employer’s share). Lowering the amount down to a 3 or more.5% (2.05% healthcare 1.45% Medicare) contribution every for earnings of 7% for lower income workers should make it affordable for workers and employers.

Although the time open a lot of people, many people will not meet automobile to generate the EIC. Individuals who obtain the EIC must be United States citizens, possess a social security number, earn a taxable income, be over twenty-five years old, not file for taxes underneath the Married Filing Separately category, and have a child that qualifies. Meeting these requirements is step 1 in receiving the earned income credit.

Ways to Attack: When you continue to arrive unfiled making use of IRS, may never give them more than enough jurisdiction to retrieve the big guns. Could put a lien as part of your credit, that practically ruin it and also. A levy can be transfer pricing applied on this bank account; that means you are frozen out of your own assets. And last even so, not least, the internal revenue service has the suitable to garnish up to 80% of the paycheck. Believe me; I’ve used these tactics on enough others to tell you that really don’t want to deal with all of them.

This tax credit now is easier to obtain if you might have a child, but doesn’t mean an individual will automatically get which it. In order to be given the EIC on the basis of your child, the child must be under eighteen years of age, under age twenty-four and currently taking post-secondary classes, or higher eighteen connected with age with disabilities in which cared for by a parent or guardian.

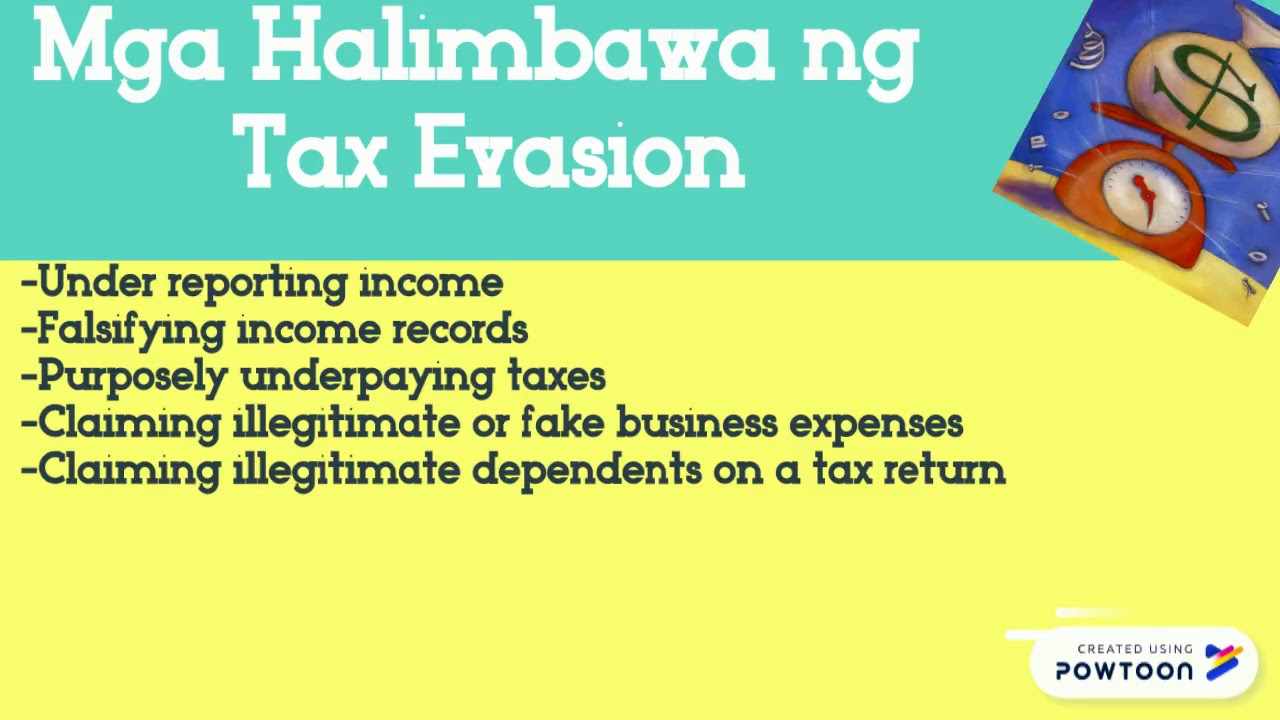

But what’s going to happen on event a person happen to forget to report with your tax return the dividend income you received from a investment at ABC banking company? I’ll tell you what the interior revenue people will think. The interior Revenue office (from now onwards, “the taxman”) might misconstrue your innocent omission as a xnxx, and slap families. very hard. through administrative penalty, or jail term, to educate you yet others like you with a lesson also it never overlook!

Structured Entity Tax Credit – The irs is attacking an inventive scheme involving state conservation tax credit. The strategy works by having people set up partnerships that invest in state conservation credits. The credits are eventually consumed and a K-1 is issued to the partners who then consider the credits with their personal pay back. The IRS is arguing that there is no legitimate business purpose for the partnership, it’s the strategy fraudulent.

That makes his final adjusted revenues $57,058 ($39,000 plus $18,058). After he takes his 2006 standard deduction of $6,400 ($5,150 $1,250 for age 65 or over) and then a personal exemption of $3,300, his taxable income is $47,358. That puts him involving 25% marginal tax segment. If Hank’s income arises by $10 of taxable income he will pay for $2.50 in taxes on that $10 plus $2.13 in tax on extra $8.50 of Social Security benefits that will become taxed. Combine $2.50 and $2.13 and an individual $4.63 or possibly 46.5% tax on a $10 swing in taxable income. Bingo.a fouthy-six.3% marginal bracket.